Over the last decade, technology has been evolving exponentially. It has poured significant impacts on individuals' way of living as well as completely transforming business operations. However, bookkeeping and accounting are no exceptions. Additionally, leaps in technological advancements such as cloud technology, machine learning, data mining and data science are reshaping the financial industry and integration of these emerging technologies is quite beneficial for businesses. Additionally, access to complex accounting and bookkeeping software is made robust and more reliable. Thus, business finance management, data analyzing and measuring economic statistics have never been simpler than before.

Financial Management Industry Transformation - A Basic Overview

Before technology advancements, the financial management industry relied on manual means to handle, manage and streamline business finance. Specifically, the inhouse accounting and bookkeeping teams were responsible for closely looking at financial matters, making reports, handling in or out cash flows and much more. However, the conventional means began to get outdated or in more simple terms they became unreliable. As financial matters are quite confidential and require utmost security measures, there was a dire need for technology solutions to re-shape the concept of accounting and bookkeeping along the way businesses tend to practice. However, as new technologies started to emerge, they collectively impacted business operations including finance. With technological revolutions, businesses are now going paperless, and the tiring and time taking financial matters are now done automatedly through analytics and applications. Such solutions are assisting accountants and bookkeepers to get the best out of task-oriented projects and also their roles are being modernized, making them business advisers.

Additionally, the smart accounting and bookkeeping solutions are capable of doing hectic and complex business financial operations in a short period of time, reducing the cost along with making operations efficient while increasing the employees’ productivity. Read on and learn how the emerging technologies are evolving financial services that are helping businesses grow

Cloud-Based Accounting

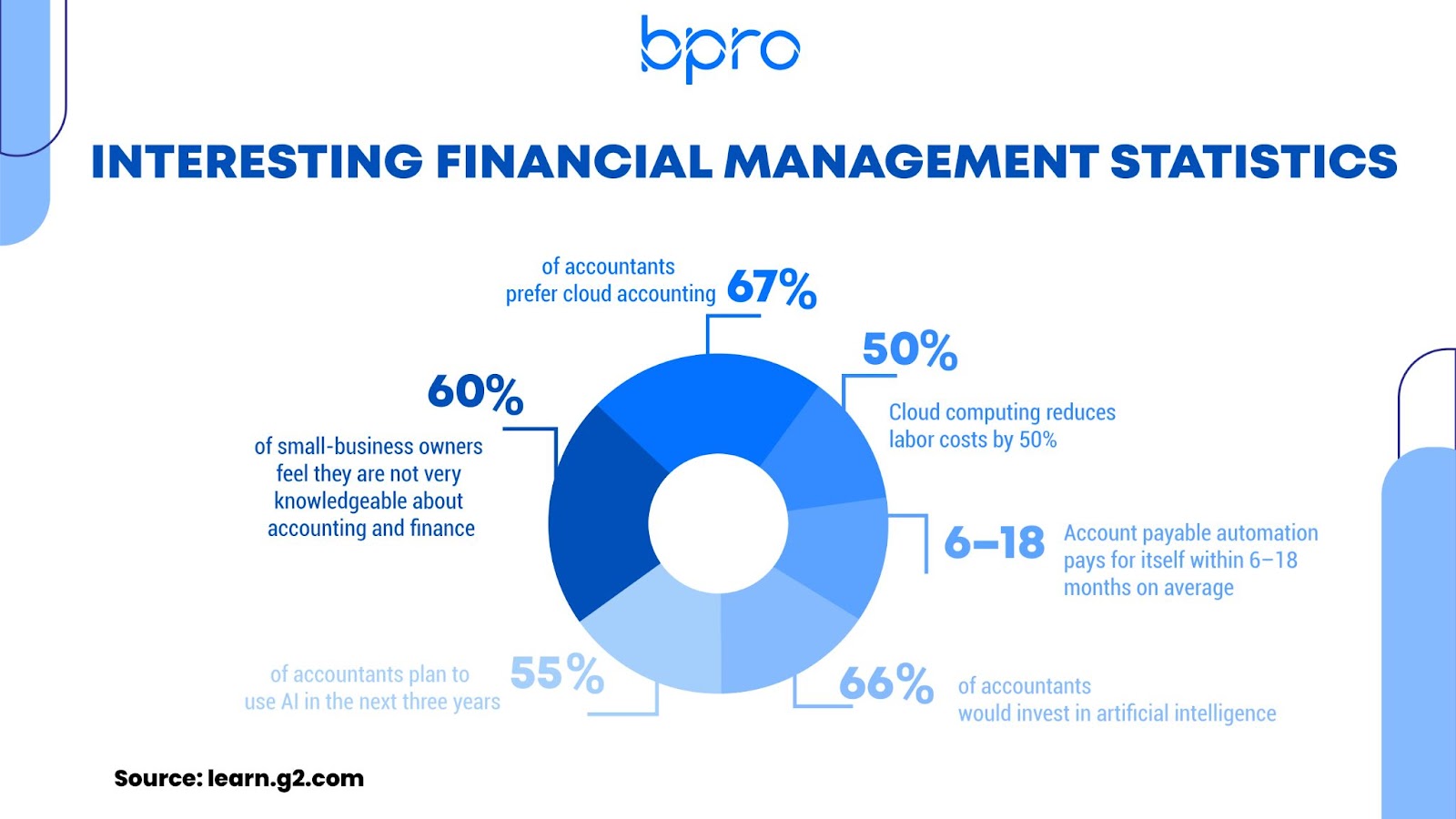

Cloud computing is one of the most innovative types of internet-based computing that holds and shares resources and sensitive data over the cloud and provides instant access from anywhere around the world. This enables accounts and bookkeepers to perform financial tasks remotely along with the ability to deliver financial assistance through cloud solutions. This technology also unlocks new business opportunities for financial management service providers to make partnerships with clients. Thus, there is more time to collaborate with customers and pay more focus on developing business strategies instead of getting stressed out with hectic processes. Additionally, the cloud-based software also mitigates the dependency on spreadsheets or a box of receipts to develop customer relationships. Businesses can also use cloud accounting for client assessments, run and create payroll in bulk, and file taxes to government agencies. Thus, allowing clients to collaborate in real-time, cloud-based accounting and bookkeeping services can allow businesses to invest more time in managing core-value tasks.

Automating Tasks

As technologies are getting modernized, accounting and bookkeeping services are getting automated. The enhanced financial management systems are proficient in handling business operations that may require more time and money if done traditionally. Through artificial intelligence and machine learning, repetitive and complex tasks including inputting, reconciling transitions, forecasting budgets and much more can be carried out automatedly. Additionally, the new trend of open banking also allows financial transactions to be imported into the business accounting and bookkeeping systems, where machine learning models automatedly explain the transactions based on the past client’s activities. Moreover, automation also reduces the risk of human errors, while providing more accurate results that can make businesses credible.

Providing Greater Insight into Clients’ Businesses

As emerging technologies are solving existing business problems, time and efforts that were previously wasted in travelling to attend meetings or manually input data can now be invested in more prioritized business operations. For instance, thoroughly examining the business's financial status, providing detailed insights into customers’ finance, and suggesting effective strategies in order to dedicate more time to developing credible client relationships. Despite to what extent technology evolves, it's likely that future accounting and bookkeeping services will reduce the time for businesses for managing finance, file tax returns and make accurate audits in a precise manner helping companies to scale their operations.

Mobile Accounting

With mobile technology, accountants, and financial analysts have been interacting and collaborating with their clients virtually for years. More recently, video conferencing software like google meet and zoom have emerged and set the new norm for remote meetings. Additionally, these applications become the critical communication channel for businesses to guide their clients.

However, bookkeepers and accountants are increasingly using smartphones to access data. Mobiles are also becoming the bridge that is helping financial management service providers virtually interact with clients. Mobile applications help bookkeeping and accounting companies manage their clients' businesses while on the move. The firms can send or generate invoices, add receipts, reconcile, forecast budgets, manage in/out cash flows and create expense claims from mobile phones.

Scheduling and Time-tracking

Scheduling daily tasks for employees and tracking their productivity using automated solutions or applications has been a helping hand for all kinds of businesses. The same goes for accounting and bookkeeping service providers. Managing employees and being sure that designated tasks are delivered on time while maintaining rigid standards of quality requires an innovative solution powered by technology. As the financial management trends are transforming and new practices are becoming essential, such as work from home, outsourcing, BYOD and much more. While control methods in bookkeeping and accounting companies are not as simple as they used to be. Thus, this is the point where emerging technologies take over the lead. Emerging innovative bookkeeping solutions mitigates the need for traditional ways of monitoring or assigning employees' productivity.