Accounting might not be an interesting topic when entrepreneurs are launching a startup. It brings to mind complex financial spreadsheets and manages the bulk of data. But business success depends on accurate and robust accounting solutions. However, people start companies to generate money, this can never be achieved without strong accounting techniques or tools like tax documents, balance sheets, business budgets and forecasts.

To scale and run a startup in this fast-moving economy, business owners need to be flexible as well as have exceptional planning, managing and organizational skills. Accounting is also one of them. Therefore, it's critical for every startup to have knowledge as well as the competency of developing a solid accounting foundation to stay competitive, enhance efficiency, boost productivity, streamline financing, manage expenses and determine the possible opportunities and risks for the businesses.

Accounting For Startups - A Short Overview

The startup world is full of uncertainties. In this unstable environment, accounting is considered an essential resource for keeping up with financial stability. Thus, accountants can help emerging businesses by providing assistance and advice for managing financial operations including cash flow management, forecasting, budgeting, tax planning and every bit of other essential organizational operations. In addition to this, they can also help in increasing the company’s capital through a series of loans or tax incentives that can make it easier for startups to grow. Making it simple, accounts are the backbone of every business.

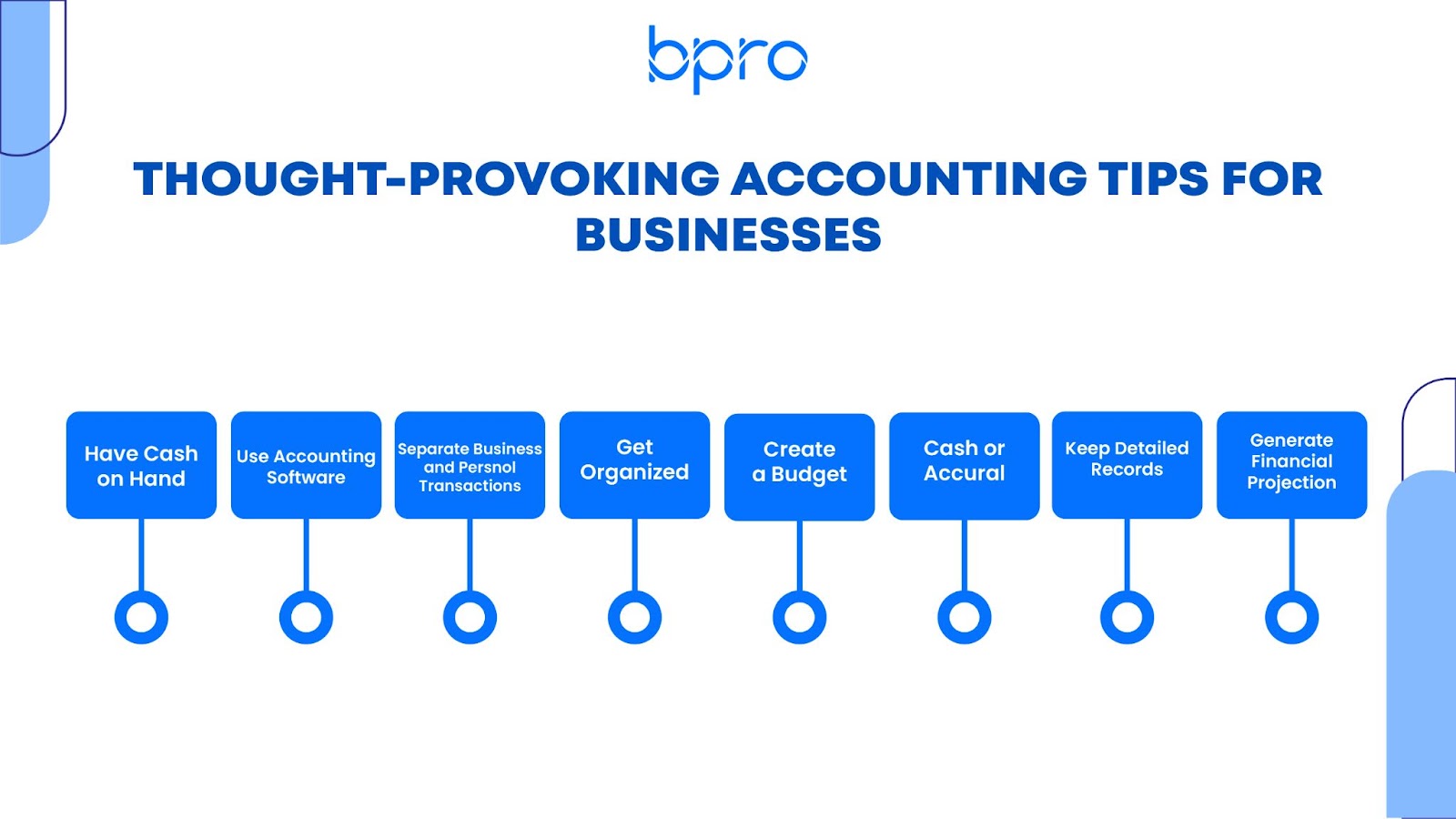

1 Use Accounting Software

Logging into business accounts on a daily basis and writing checks blindly is not a smart way of handling finance nor is it recommended. Practising this in the early stages of business development is an even more worthy idea. However, to make well-informed and fruitful decisions for a startup that promises results in both the short and long term, business owners need to have a good grip on business finances so that they always have the current standing in mind. The most suggested and effective way to ensure this is through automated technology-powered accounting systems, that are purposely developed to assist businesses in their financial operations. Such solutions are robust, error-free and accurate, all-in-all solutions for startups to scale business.

2 Have Cash on Hand

To transform a startup into a well-established enterprise, cash flow holds great significance. Business owners or entrepreneurs don't need to wait for the proverbial rainy days to ambush startups. Accountants and financial analysts suggest that having ample cash that can back business to remain operational for at least three months in hard times, but getting closer to six months is, even more, better as it completely overcomes the risk of bankruptcy. In addition to this, the startup also needs to plan as well as look ahead to the cash they need to spend in the upcoming two years. Planning will let them know whether they have enough cash to run a business or need to look out for loans or some partners.

3 Get Organized

In the early phase of a startup’s development, operations and things usually get messy. In order to achieve success and get onto the road to growth, they need to get organized. This, fortunately, helps businesses to complete their day-to-day task and stay on top of goals to be done. A good way of organizing business data is creating daily task sheets. As they achieve the goal of completing a task, they can easily check it off the list. This ensures that no undone task gets delayed or forgotten. This is an essential way of surviving the early crunch. To further help startups to float, many software as a service software also exists to assist them in getting organized. These tools include Trello, Excel, Microsoft Teams and much more.

4 Keep Detailed Records

Every successful business in the world keeps detailed insights of their standing that help them to remain competitive. Keeping company records in a well-managed manner will help owners to know where their firm is standing and what possible opportunities or risks they can experience in the near future. Just knowing the insights businesses can get enough time to structure strategies to counter any kind of challenge.

However, most companies usually choose to keep information in two ways, one physical and the other in the cloud. However, physical backups also exist in order to make alterations as well as ensure the information kept is authentic and error-free.

5 Cash Or Accrual

Startups need to be sure and have certain goals before selecting the accounting types that they will require for management. However, there are two different types of accounting that are usually used by every kind of business. The first is cash and the second is the accrual accounting method. Startups need to know and learn what type of accounting strategies they want to use. This will help businesses to determine the best options for financing operations and is a first step in building a strong foundation for the business.

6 Create A Budget

Without a budget or proper planning, no business can survive the initial phase of development. Thus, startups, as well as small businesses, need to plan budgets and spend accordingly, otherwise, things can be worse. However, it doesn't matter how much a startup will generate revenue, they still need to create a budget depending on the finance they got in reserves. Adding more, startups need to develop startup as well as operations budgets. This will help emerging businesses manage finance on their own, resulting in overcoming the risk of getting drowned under debts. Furthermore, budgets also play a critical role in managing business accounting methods.

7 Generate Financial Projections

Financial projections are essential for businesses as it helps them to forecast future income and expenses as well as provide detailed insights into if they will run out of cash or not. Business finance forecasting also assists owners in estimating cash flows as well as identifying the right time when to change development plans or prices. In addition to this, forecasts also provide valuable financial information to the business stakeholders when there is a need of seeking funding or a loan. However, these projections are based on financial modelling techniques and provide the answers to a question that may come into owners, stakeholders or investors' minds. Such concerns include, what will they need to do or how will they pay back the debts after taking loans.

8 Separate Business and Personal Transactions

One of the most critical aspects of managing accounting services is to keep personal and business financial accounts separate. Fortunately, this will back businesses to effectively track their profitability, expenses, and current cash status resulting in making tax filing a lot easier.